smartphones are a massive target for fraudulent transactions

As mobile phone numbers increasingly serve as the predominant means of identity for billions of individuals globally, financial institutions conduct verification, transactions, and sensitive communications with customers via their smartphones. This presents an opportunity for solution providers like yourself. By augmenting your offerings with authoritative and reliable digital identity data, you stand to attract more financial institutions to opt for your solution over others.

fraudsters constantly find new ways to target financial institutions

in 2023, the top three fraud methods were:

strengthen your fraud deterrence solutions

- Differentiate your products and solutions by touting you include the only security constant across the globe—an authoritative phone number database constantly updated for accuracy

- Enhance your clients’ financial performance with solutions that minimize fraud reimbursements and lower operational expenses through effective fraud mitigation measures

- Augment existing processes and systems to mitigate Anti-Money Laundering (AML), account opening fraud, and imposter fraud for your clients

featured customers

Mobile phone numbers are a proven method for making it easier for genuine customers to interact with businesses while making it more challenging for fraudsters to succeed. The result is maximized customer satisfaction and sales, coupled with minimized risks and losses, including from advanced AI scams like deepfakes.

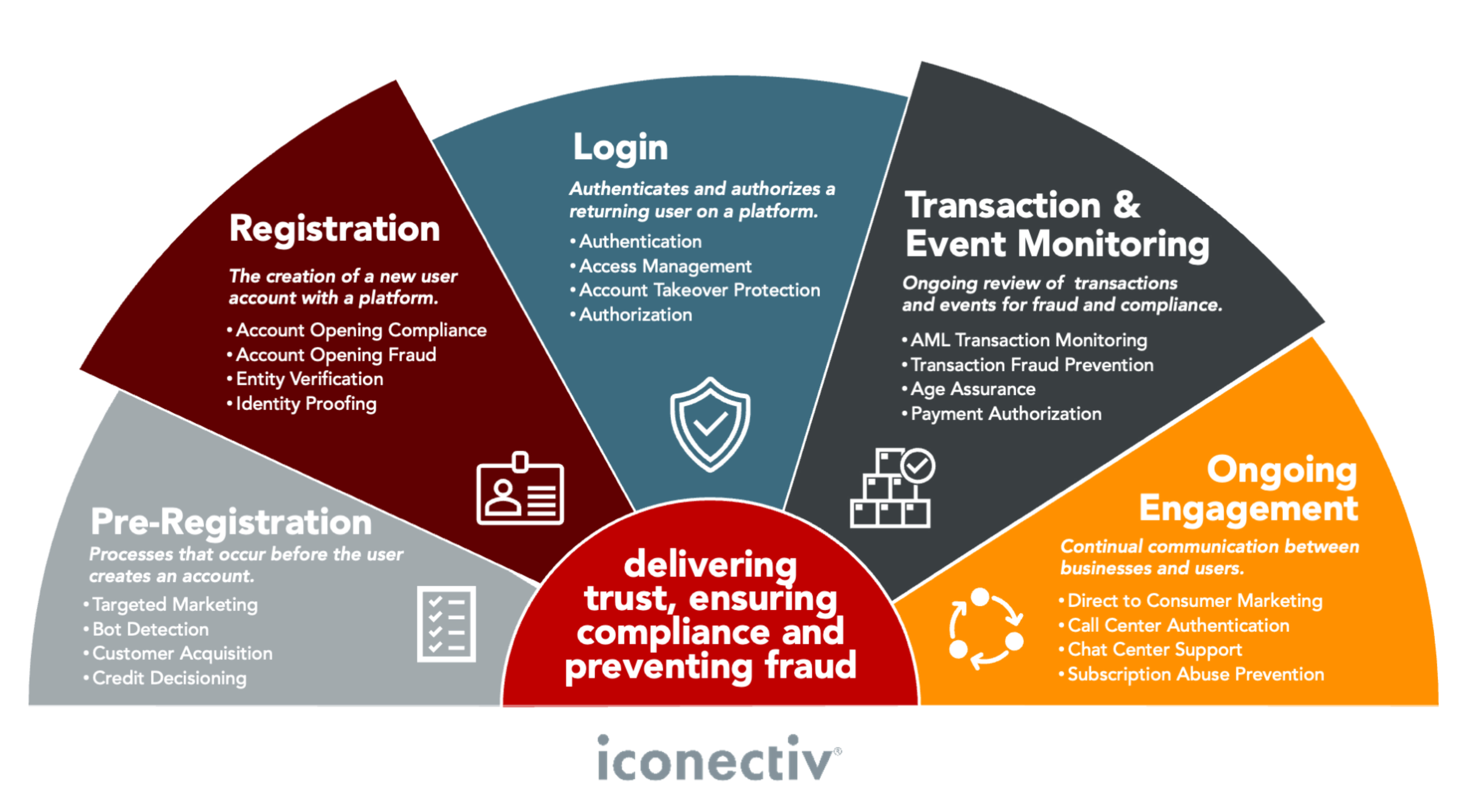

identity intelligence throughout the customer lifecycle

The universal role of smartphones in managing personal finances and conducting transactions creates a fertile atmosphere for exploiting vulnerabilities across the customer life cycle. iconectiv’s data and platforms will enhance your solutions every step of the way:

- customer journey

- pre-registration

- customer registration

- customer login

- transaction & event monitoring

- ongoing engagement

Ensure marketing, customer acquisition, and credit activities are verifiable and secure before a user creates an account.

• Targeted Marketing

• Bot Detection

• Customer Acquisition

• Credit Decisioning

Strengthen the registration process by implementing rigorous compliance measures, advanced fraud detection systems, thorough entity verification procedures and comprehensive identity proofing protocols.

• Account Opening Compliance

• Account Opening Fraud

• Entity Verification

• Identity Proofing

Authenticate and authorize returning users for a frictionless experience coupled with account management and takeover protections.

• Authentication

• Access Management

• Account Takeover Protection

• Authorization

• AML Transaction Monitoring

• Transaction Fraud Prevention

• Age Assurance

• Payment Authorizations

• Direct-to-Consumer Marketing

• Call Center Authentication

• Chat Center Support

• Subscription Abuse Prevention

- customer journey

- pre-registration

- customer registration

- customer login

- transaction & event monitoring

- ongoing engagement

ready to get started?

learn how trust, compliance, and fraud prevention can boost your business